Understanding Startup Business Loans

Before diving into the specifics, it's important to grasp what a startup business loan is and why it’s vital for your new venture. These loans are designed to provide capital to new businesses that might not yet have a track record or substantial assets. The funds can be used for various purposes, including equipment purchases, marketing efforts, and operational costs.

Types of Startup Business Loans

- SBA Loans: The Small Business Administration (SBA) offers several loan programs tailored for startups. These include the 7(a) loan program, which is popular for its flexibility and low interest rates.

- Term Loans: Traditional loans from banks or credit unions that provide a lump sum of capital with a fixed repayment schedule.

- Business Lines of Credit: A revolving line of credit that allows you to withdraw funds as needed, similar to a credit card.

- Angel Investors and Venture Capital: While not loans, these investment options can provide capital in exchange for equity in your startup.

Steps to Secure a Startup Business Loan

Securing a startup business loan involves several key steps. Here's a streamlined approach to make the process easier:

1. Develop a Solid Business Plan

A well-crafted business plan is crucial. It should outline your business goals, market analysis, revenue projections, and how you plan to use the loan funds. Lenders will use this plan to assess the viability of your business.

Chart 1: Essential Elements of a Business Plan

| Element | Description |

|---|---|

| Executive Summary | Brief overview of your business and objectives |

| Market Analysis | Research on target market and competitors |

| Organization | Structure and management team details |

| Products/Services | Description of what you offer and your unique selling proposition |

| Financial Projections | Revenue, profit, and cash flow forecasts |

2. Assess Your Financial Needs

Determine how much funding you need and how you’ll use it. This will help you identify the type of loan that best suits your needs.

3. Check Your Credit Score

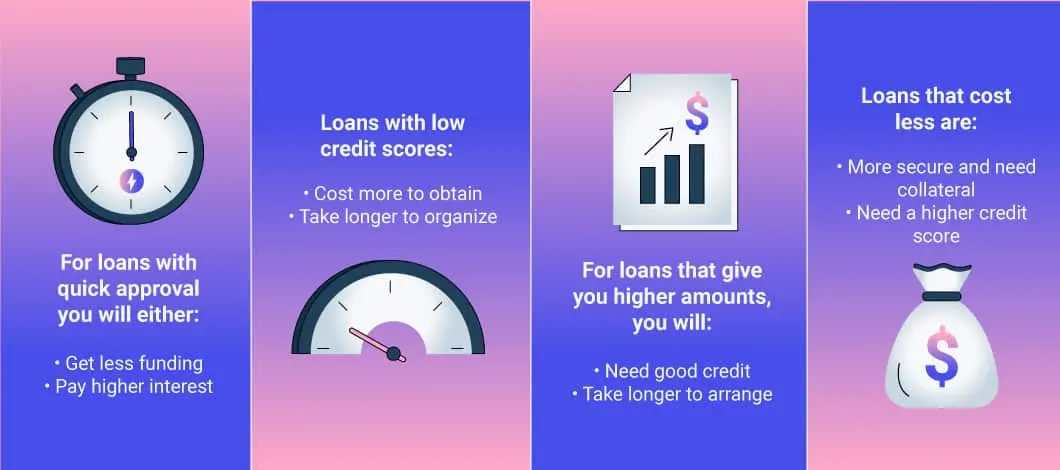

Your personal and business credit scores can impact loan approval. Ensure your credit reports are accurate and address any issues before applying.

Chart 2: How Credit Scores Affect Loan Approval

| Credit Score Range | Impact on Loan Approval |

|---|---|

| Excellent (750+) | High chance of approval with favorable terms |

| Good (700-749) | Good chance of approval, moderate terms |

| Fair (650-699) | May face higher interest rates and stricter terms |

| Poor (Below 650) | Difficult approval and higher interest rates |

4. Prepare Your Documents

Lenders typically require the following documents:

- Business Plan

- Personal and Business Credit Reports

- Financial Statements (income statement, balance sheet, cash flow statement)

- Tax Returns (personal and business)

- Legal Documents (business license, incorporation papers)

5. Explore Loan Options

Compare different lenders and loan products. Consider interest rates, repayment terms, fees, and eligibility requirements. It’s also wise to consult with a financial advisor or loan broker to find the best fit for your startup.

Chart 3: Comparison of Popular Loan Types

| Loan Type | Interest Rate | Repayment Term | Pros | Cons |

|---|---|---|---|---|

| SBA 7(a) | 5.5% - 8.0% | Up to 25 years | Low rates, flexible terms | Lengthy application process |

| Term Loan | 6.0% - 12.0% | 1 - 10 years | Fixed terms, straightforward | Higher rates for startups |

| Business Line of Credit | 7.0% - 20.0% | Revolving credit | Flexible access to funds | Variable interest rates |

6. Submit Your Application

Once you’ve selected a lender and loan product, complete the application process. Ensure all information is accurate and complete to avoid delays.

Tips for a Successful Loan Application

- Be Transparent: Provide honest and complete information to build trust with lenders.

- Show Proof of Revenue: Even if it’s limited, showing that you have some revenue can improve your chances.

- Highlight Your Experience: Demonstrating your industry knowledge and experience can strengthen your application.

Conclusion

Securing a startup business loan doesn’t have to be an overwhelming task. By understanding the types of loans available, preparing thoroughly, and exploring your options, you can position your startup for success. Use this guide to navigate the loan process with confidence and take the next step towards building your business empire.