The Rise of Same Day Business Loans

Traditional business loans often involve lengthy application processes, extensive paperwork, and waiting periods that can stretch for weeks. However, the advent of online lending platforms and fintech innovations has revolutionized the way businesses access capital. Same day business loans have become increasingly popular due to their convenience, speed, and accessibility.

Key Drivers of Growth

- Technological Advancements: The integration of technology in the financial sector has streamlined the loan approval process. Digital lending platforms leverage algorithms and data analytics to quickly assess a business's creditworthiness, reducing the time needed for approval.

- Increased Demand for Quick Financing: Businesses often face unexpected expenses or opportunities that require immediate funding. Same day business loans provide a solution by offering rapid access to capital, allowing businesses to respond swiftly to changing circumstances.

- Flexible Loan Options: Unlike traditional loans, same day business loans offer flexibility in terms of repayment schedules and loan amounts. This flexibility makes them an attractive option for businesses of all sizes, particularly small and medium-sized enterprises (SMEs).

Benefits of Same Day Business Loans

Same day business loans offer several advantages that make them an essential financial tool for businesses:

1. Speed and Convenience

One of the most significant benefits of same day business loans is the speed at which funds are disbursed. Once approved, businesses can receive the funds within hours, enabling them to address immediate financial needs.

2. Minimal Documentation

Traditional loans often require extensive documentation, which can be time-consuming and burdensome. In contrast, same day business loans typically require minimal paperwork, making the application process quick and straightforward.

3. Improved Cash Flow Management

For businesses with fluctuating cash flow, same day business loans can provide a crucial safety net. These loans can help bridge cash flow gaps, ensuring that businesses have the necessary funds to meet payroll, purchase inventory, or cover other operational expenses.

4. Access to Capital for SMEs

Small and medium-sized enterprises often face challenges in securing funding through traditional channels due to stringent eligibility criteria. Same day business loans offer an alternative, providing SMEs with the capital they need to grow and thrive.

The Impact of Same Day Business Loans on the Financial Landscape

The growing popularity of same day business loans is reshaping the financial landscape, offering businesses more options and flexibility than ever before. The following chart illustrates the growth of same day business loans compared to traditional business loans:

| Year | Same Day Business Loans (in billions) | Traditional Business Loans (in billions) |

|---|---|---|

| 2020 | $10 | $50 |

| 2021 | $20 | $45 |

| 2022 | $35 | $40 |

| 2023 | $50 | $35 |

| 2024 (est) | $70 | $30 |

As the chart demonstrates, the demand for same day business loans has grown significantly, while traditional business loans have seen a decline. This trend highlights the increasing preference for quick and flexible financing options among businesses.

Choosing the Right Same Day Business Loan

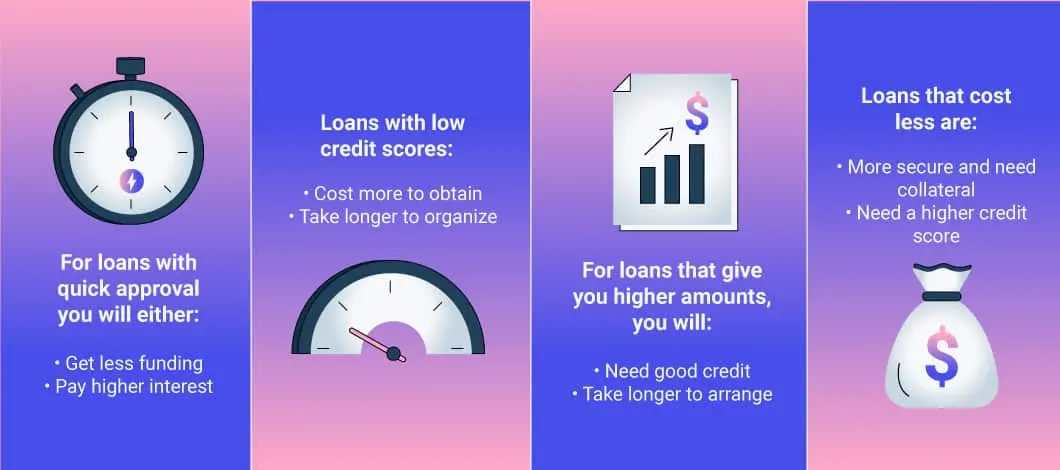

When considering a same day business loan, it's essential to evaluate the terms and conditions offered by different lenders. Key factors to consider include:

- Interest Rates: Compare the interest rates offered by various lenders to find the most affordable option.

- Repayment Terms: Look for loans with flexible repayment schedules that align with your business's cash flow.

- Eligibility Requirements: Ensure that your business meets the eligibility criteria set by the lender.

- Fees and Charges: Be aware of any additional fees, such as origination fees or prepayment penalties.

Conclusion

Same day business loans have emerged as a vital financial resource for businesses seeking quick and convenient access to capital. Their popularity continues to grow, driven by technological advancements, increased demand for rapid financing, and flexible loan options. As businesses navigate an ever-changing economic landscape, same day business loans provide a valuable tool for maintaining cash flow, seizing opportunities, and ensuring long-term success.

By leveraging same day business loans, businesses can stay agile and responsive, ready to tackle challenges and capitalize on new opportunities. As the financial landscape continues to evolve, the importance of quick and accessible funding will only increase, making same day business loans an essential component of modern business finance.