1. Pre-Qualification and Pre-Approval

Pre-qualification is the initial step in the mortgage process. It involves providing your lender with basic financial information, such as income, debt, and assets, to determine the loan amount you may qualify for. This is not a commitment but gives you an idea of your budget.

Pre-approval, on the other hand, is a more detailed process that requires you to submit financial documents. The lender will verify your credit, income, and employment status to issue a pre-approval letter. This letter is crucial when making offers on homes, as it shows sellers you are a serious buyer.

2. Choosing the Right Mortgage

Selecting the right mortgage product is essential. There are various options, including:

- Fixed-rate mortgages: The interest rate remains constant throughout the loan term.

- Adjustable-rate mortgages (ARMs): The interest rate may change periodically based on market conditions.

- FHA loans: Backed by the Federal Housing Administration, these loans are ideal for first-time buyers with lower down payments.

- VA loans: Available to veterans and active military personnel, these loans often require no down payment.

3. Submitting the Mortgage Application

Once you have chosen a mortgage, you'll need to complete the mortgage application. This includes providing detailed information about your financial situation, employment history, and the property you wish to purchase. The lender will also request documents such as:

- Recent pay stubs

- Tax returns

- Bank statements

- Proof of assets

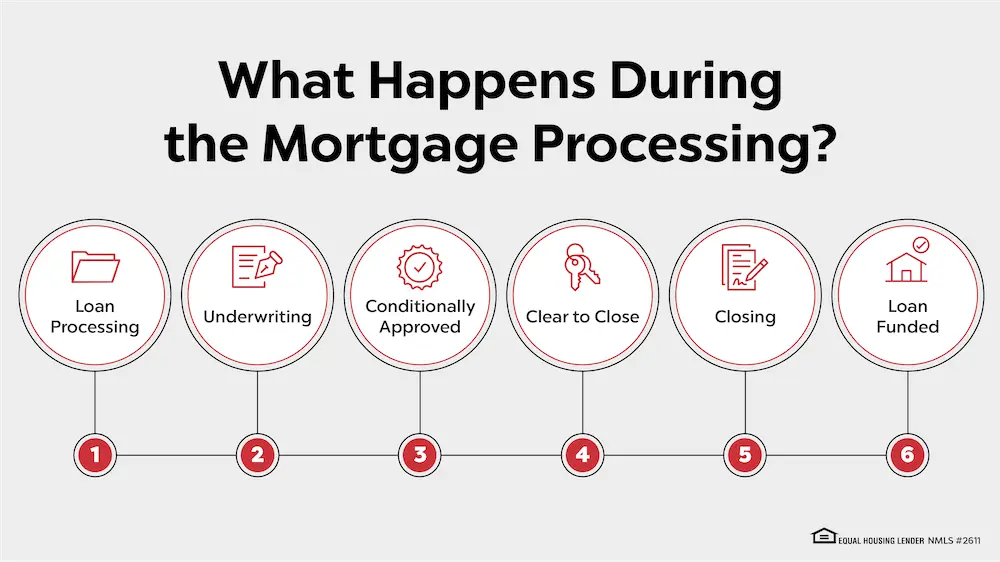

4. Underwriting Process

The underwriting process is a critical step where the lender assesses your risk as a borrower. The underwriter will review your financial information, credit history, and property details to determine whether to approve the loan. During this stage, you may be asked to provide additional documentation or clarification on certain aspects of your application.

5. Closing the Loan

If your application is approved, the next step is closing the loan. This involves signing the final paperwork, paying closing costs, and officially transferring ownership of the property. You'll also receive the keys to your new home!

Common Mortgage Terms and Their Meanings

Understanding common mortgage terms is crucial for navigating the loan process. Here's a quick reference:

| Term | Definition |

|---|---|

| Principal | The amount of money borrowed. |

| Interest Rate | The percentage of the loan charged as interest by the lender. |

| APR (Annual Percentage Rate) | The total cost of borrowing, including interest and fees. |

| Down Payment | The initial payment made when purchasing a home. |

| Escrow | An account used to pay property taxes and insurance premiums. |

Tips for a Smooth Mortgage Application Process

- Check Your Credit Score: Ensure your credit score is in good shape before applying.

- Gather Documentation: Have all necessary documents ready to speed up the process.

- Compare Lenders: Shop around for the best interest rates and terms.

- Avoid Major Purchases: Don’t make significant purchases or open new credit lines during the application process, as this can affect your credit score and loan approval.

Conclusion

The mortgage loan application process can seem overwhelming, but understanding each step can make it more manageable. From pre-qualification to closing, being prepared and informed will help you navigate the process smoothly. Whether you're a first-time homebuyer or refinancing your existing home, these tips will guide you toward a successful mortgage application.

For more information on the mortgage loan process or to get started with a pre-qualification, contact a mortgage lender today!