Top Mortgage Lenders in 2024

In 2024, several mortgage lenders are renowned for their competitive rates, customer service, and innovative solutions. Here are the top players in the industry:

- Quicken LoansQuicken Loans, now known as Rocket Mortgage, continues to lead the market with its user-friendly online platform and robust customer support. They offer fast approvals and competitive rates.

- Wells FargoWells Fargo remains a strong choice for traditional homebuyers. They provide a variety of mortgage products and have a reputation for personalized service and comprehensive financial advice.

- ChaseChase offers a range of mortgage options and competitive interest rates. Their comprehensive online tools and in-person support make them a versatile choice for many buyers.

- Bank of AmericaKnown for their low down payment options, Bank of America provides various mortgage solutions and offers substantial financial guidance throughout the process.

- LoanDepotLoanDepot stands out with its quick online application and no lender fees option, appealing to tech-savvy borrowers who prefer a streamlined process.

Mortgage Loan Types

Understanding the different types of mortgage loans available can help you select the best fit for your financial situation. Here are the most popular loan types in 2024:

- Fixed-Rate MortgagesFixed-rate mortgages are ideal for those who prefer predictable payments and long-term stability. These loans feature a consistent interest rate throughout the life of the loan.Average Interest Rates (2024):15-Year Fixed: 2.75%30-Year Fixed: 3.25%

- Adjustable-Rate Mortgages (ARMs)ARMs offer lower initial rates compared to fixed-rate mortgages but come with the risk of rate adjustments after a specified period. These are suitable for borrowers planning to move or refinance within a few years.Initial Interest Rates (2024):5/1 ARM: 2.50%7/1 ARM: 2.75%

- FHA LoansFederal Housing Administration (FHA) loans are backed by the government and are ideal for first-time buyers with lower credit scores. They offer lower down payments and more flexible credit requirements.Average Down Payment: 3.5%

- VA LoansVA loans, available to veterans and active military members, offer no down payment options and competitive interest rates. These loans are backed by the Department of Veterans Affairs.Average Interest Rates (2024): 2.75%

- USDA LoansThe U.S. Department of Agriculture (USDA) provides loans for rural and suburban homebuyers. These loans require no down payment and offer competitive interest rates.Average Interest Rates (2024): 2.85%

Choosing the Right Mortgage for You

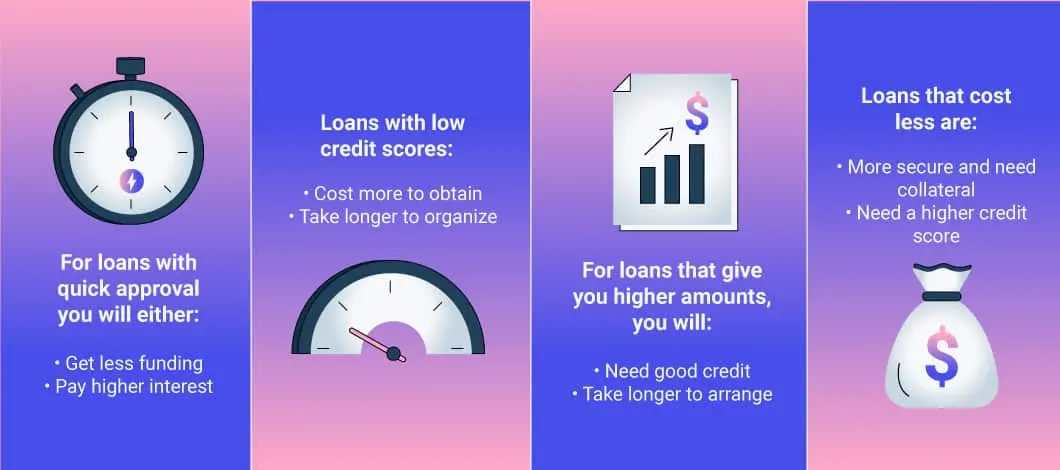

Selecting the perfect mortgage involves evaluating your financial situation, long-term plans, and the specific features of each loan type. Consider the following factors:

- Interest Rates: Compare current rates to ensure you get the best deal.

- Down Payment: Determine how much you can afford to put down initially.

- Loan Term: Decide between a shorter or longer loan term based on your financial goals.

- Loan Type: Choose between fixed, adjustable, or government-backed loans based on your needs.

Conclusion

Navigating the mortgage landscape in 2024 requires careful consideration of both lenders and loan types. By understanding the top mortgage lenders and the various loan options available, you can make an informed decision that aligns with your financial goals and homeownership aspirations. Use the provided charts to compare rates and features, and consult with a financial advisor to tailor the best mortgage solution for your situation.